Results of the 2nd annual Insect Industry Survey, part 1 of 3

In 2023 we launched the annual insect industry survey from the scratch and got a great amount of responses, but now in 2024 we are happy to have got even more responses than last year – Thank You for that!

I will go thru the results one by one in 3 different articles, as there is a lot to see and say! The more, the merrier, you know how it is. This is the 1st part, which will cover lots of demographic information about the respondents, and from that we can try to better understand where the insect production magic really happens, which are the hotspots, what is the state of the industry across the continents, who these people are and what they really do or plan to do.

The demographics

Let’s start with a geography lesson.

First of all, we all know that insect and black soldier fly farming especially is a new-ish and interesting opportunity, and especially so in the regions where this species lives naturally. This of course can be seen in the results as well, but the biggest hype from the business case and investment opportunity point of view seem to happen in Europe and in North America – which in this insect industry survey were represented only by a handful of people – sad.

Millions and millions of dollars are poured into startups with the promise of multiplying the investment with the help of these small creatures that many talk about, but not many really understand the business case side of things. BSF is easy to farm and may make a nice income stream especially in low income countries, but to make it a big, International business, is a whole different thing, especially if you’re building dream castles of unicorn-level fortunes that are made with insect farming. Well, we all know how realistic scenario that is… once in a blue moon. Let’s see how that is reflected in the survey results.

The top countries where the insect industry survey respondents came from:

Nigeria 15,1% of all respondents

Pakistan 14,7%

Kenya 12,4%

India 8,4%

Papua New Guinea 4,9%

Ethiopia 2,7%

South Africa 2,7%

Tanzania 2,7%

Zambia 2,2%

Zimbabwe 2,2%

Ghana 1,8%

Indonesia 1,8%

Sri Lanka 1,8%

Vietnam 1,8%

Egypt 1,3%

Malawi 1,3%

UAE 1,3%

Uganda 1,3%

USA 1,3%

Here are listed all the countries from which there were more than 1% of all respondents. Overall, we got responses from 48 countries, even from 1 we didn’t know existed… Shame on us!

As you can see from the list of top 19 countries, the focus is clearly on the regions where BSF lives naturally – Africa, South Asia, and then the U.S. as a small oddity, but a very promising location for small-scale insect farming at least.

The employers and job titles

The respondents to the insect industry survey seem to have come from all walks of life, the list of current employers is long and varied, but some interesting trends can be seen, thou. The most common employers of the respondents are typically universities, government offices such as Ministries, and various NGOs and institutes.

Unfortunately, we didn’t get any responses from the big, commercial players of the industry… Ynsect, Protix, Innovafeed, and almost all other familiar names are missing totally from the respondent list. I guess they’re just not that interested in the industry as such, but rather their own business. Snap! Shame on you.

Many respondents were either self-employed or students. Oh yes, and we got responses from 1 retired person, which is great! Insect farming doesn’t require certain age, sex, income level, educational background or certificate, you don’t need to own a house or a car, or be married or single, and it’s an interesting industry because of that!

We expect there to be millions of insect farmers in the future, and for that to happen, we welcome people from various backgrounds to consider this an opportunity to make a job and livelihood for themselves, start a business, get side income to go with your actual daily work, or a chance to make savings in your waste management costs or feed costs. It’s all okay!

The most common job titles were either related to working at a university as a student, researcher, teacher, lecturer or professor, or having your own company and being the CEO or Managing Director of this entity. I guess this is a “startup syndrome”, where there may only be 2-3 people in the company, but they are all with C-level titles, such as CEO, CTO, COO, CMO, CFO, etc. – and that’s totally fine, we’ve been there too, but you can’t deny it being kind of funny to be the CEO of 1 other person 🙂 Hats off to all those CEOs, no matter the company size, it’s still a responsible job and requires hard work, sometimes long hours, and being the face of the company in good as well as in bad times.

Other typical job titles were related to being agronomist or farmer. We also had lots of people working with animal health, entomology, aquafeed / fish farming, and – a bit strangely – in sales management. Another interesting aspect was to notice that many had job titles related to project management, which sounded like insect farming – or at least getting started with it – is quite often related to a project of sort. Perhaps it’s a grant thing, or people working in consultancies related to insect farming or animal feed.

One other noticeable thing were job titles related to innovation, which I believe relate to bigger companies considering either farming insects or using insects (or parts of insects or post-products) as part of their own product development. Biomedicine and alt-protein food ingredients come to mind when looking at certain individual companies where the respondents came from.

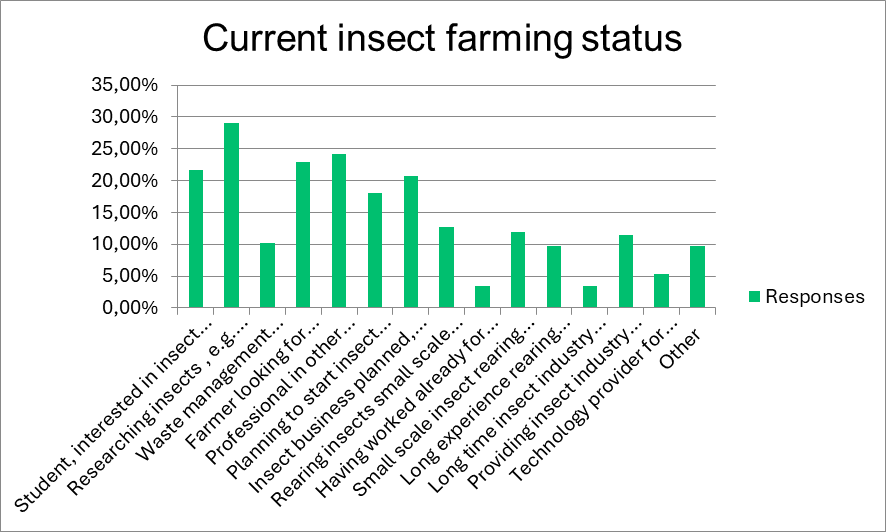

The current insect farming status, size of operation and plans

The current status of our respondents relates closely to their current employers and job titles in the educational field. Most commonly the respondents were students or researchers interested in insect farming.

We were happy to notice that many of the respondents to the insect industry survey were coming from waste management, which is something we didn’t have that strongly represented the last time.

Also, the more traditional farmers looking into insect farming were present in masses, and quite a few stated plans of starting insect farming in the next 6 months or when they get funding. Great! Let us know if we can help you in any way!

Small scale farmers planning to scale up were present in satisfying numbers, and of course quite a few offering services or products to the insect farming industry. And only 3,5% of respondents claimed to have long experience in the industry and working with industrial (factory-size) insect farming operations. Of course the industry itself in its current state is quite new, there are not many who have worked in the industry for over 5 years.

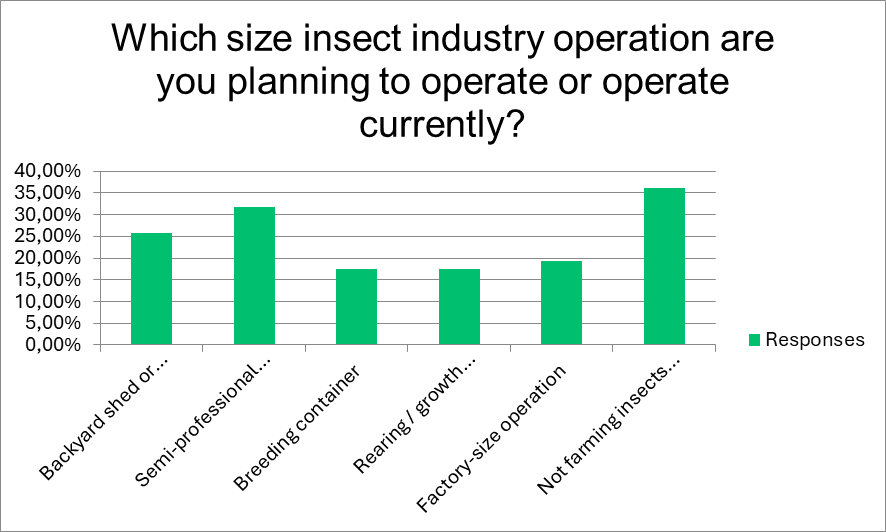

The size of operation among the respondents to the insect industry survey was a bit confusing considering the roles and employers…

Backyard shed or cages outdoors 25,69 %

Semi-professional facility with multiple rearing or breeding cages 31,65 %

Breeding container 17,43 %

Rearing / growth container 17,43 %

Factory-size operation 19,27 %

Not farming insects at the moment 36,24 %

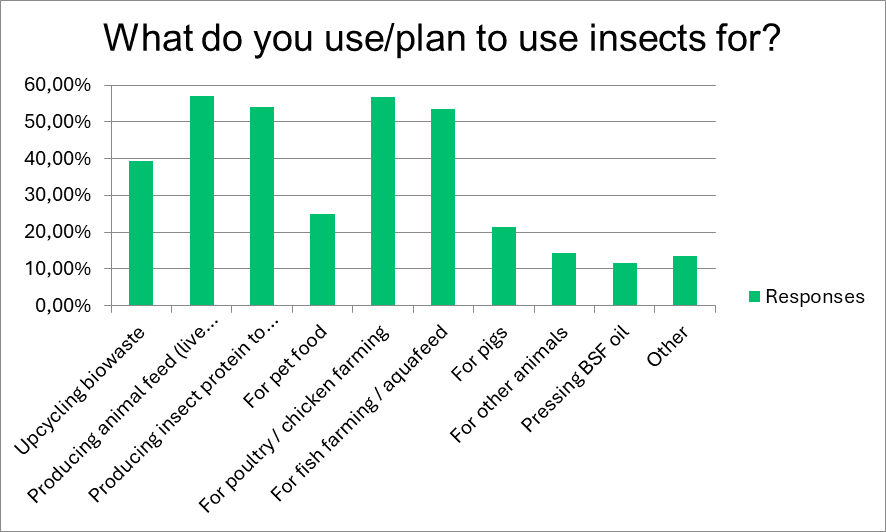

Finally, the last results for this 1st part of the results of the insect industry survey – “what do you use / plan to use insects for?”.

Most commonly our respondents farm or plan to farm insects for animal feed one way or the other. Almost 57% are feeding chicken / poultry with insects or insect protein in some form, over 57% are feeding farm animals live larvae (assuming it’s BSF), over 54% use insects as part of a farm animal diet, and over 21% were feeding pigs with insects. The numbers are of course not resulting to 100%, as the respondents could choose multiple options, but the general approach here seems to be using insects to feed farm animals.

Also fish farmers or those working with fish feed / aquafeed were well represented, as almost 54% chose the option of using insects for aquafeed. If the respondents approach insect farming from the business case point of view rather than farming insects for their own use to save in feed costs or getting rid of their own waste in a meaningful way, again, the same respondents who consider selling the insects for animal feed might just as well see the same opportunity in fish farms.

And if the respondents are focusing on black soldier fly farming, it of course doesn’t require different substrate, growth conditions, nor post-processing of any kind, no matter if the larvae are fed to pigs, chicken, pet lizards, shrimp or fish. So, the business case is more in the growing part rather than creating differentiated products out of it for different user groups. Well, that could still be a good approach from the branding and price-point points of view, but as said, not required to make business out of BSF.

Interestingly, almost 12% of the respondents to the insect industry survey consider BSF oil to be an interesting business opportunity, but I need to say this, and I say it with love – the BSF oil business case may not be there yet. The price point may be too high compared to other oils, those buying the oil often require factory-size production levels, it often requires special equipment, quality standards, etc. to be accepted by the industrial customers, and there are food safety issues and strict regulations (depends on region) related to using it as an ingredient for either human consumption or in pet foods. BSF oil may become a valid business opportunity in the long run, but for the time being, no one has been able to prove it being a great business yet, it’s all “slideware” for now, meaning that it may look good on paper, but it’s a whole different thing getting it done profitably IRL.

One more thing about the use cases, upcycling biowaste for money is a great opportunity in many countries and regions, and over 39% of our respondents considered it being an income opportunity among others, which is great! What better than getting paid to accept someone else’s waste and then use it to create sellable products, such as animal feed and frass for fertilizer. A win-win for you!

Interesting special use cases were mentioned, such as biological control (!), chitin, biomeds, cosmetics, pest control, and gut microbiome! Nice!

That’s all for this post, jump to the 2nd part of the results of the insect industry survey, that focuses more on buying and selling the insects and insect products!

And a reminder to follow us in LinkedIn!

Read also: Results of the 1st Insect Industry Survey done in spring 2023

Learn more about BSF farming in the

Insect Farm Hub!

Manna Insect has launched a comprehensive insect farming platform designed for learning, managing, monitoring and networking. There are tons of free content about insect farming, as well as a lot of paid premium content, that dives even deeper in black soldier fly business.